Retirement risks for China’s working force (1): two generat

Due to changes in population structure, China is facing big crisis in retirement. China will enter rapid aging in the next 30 years. In 2013 the population of 60-years-old above exceeded 200 million, or 14.8% of total. In 2050, it is expected that a third of China’s population will be 60-year-old above. The speed of aging will exceed most other countries in the world.

On the other hand, the size of working population continues to shrink. Data from National Statistics Bureau showed that in 2014, the population aged between 16 and 59 totaled 67%, down 0.6 percentage points compared with the same period in 2013, or equivalent to about 371 million people. This was the third consecutive year that the working population shrinks. Along with other factors such as falling birth rate and delaying of marriage, the shrink of working population will continue.

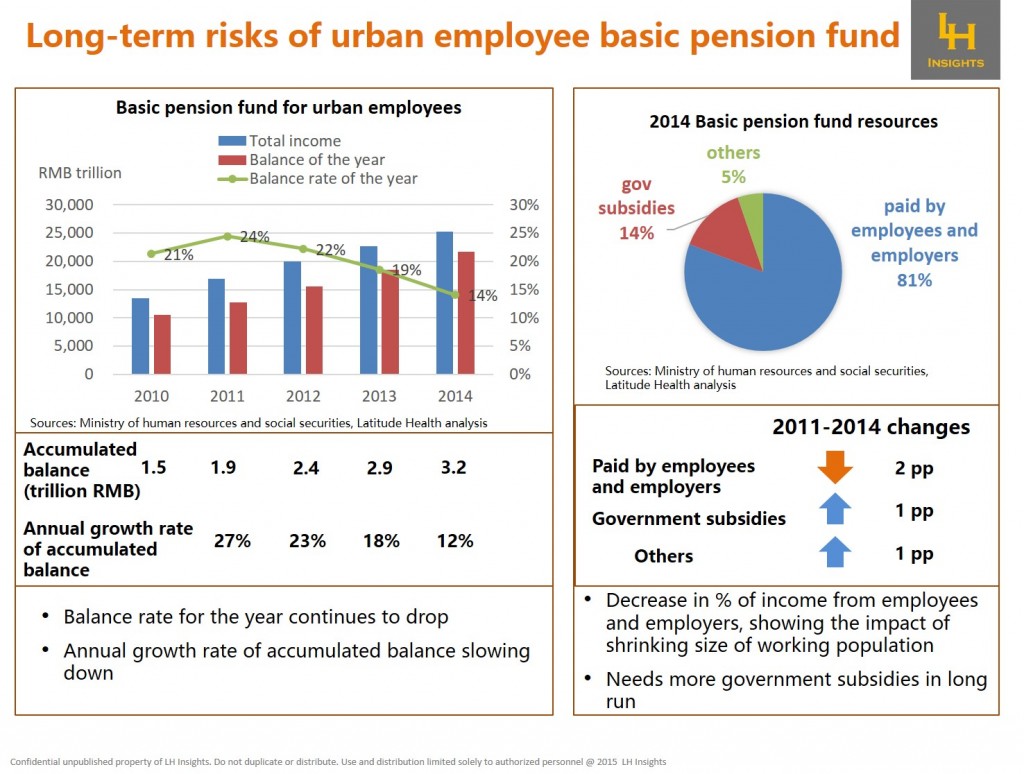

China’s basic pension insurance (the mandatory pension benefits required by the government) is also showing a subtle change, indicating that crisis might come in near future.

First, balance rate (balance/income) of the urban employee basic pension insurance fund has been declining, from 24% in 2011 to 14% in 2014. Second, the annual growth rate of accumulated surplus of the fund is slowing down, down from 27% in 2011 to only 12% in 2014. Third, the sources of the fund also showed changes. The percentage of fund collected from employees and employers was 83% in 2011, but down to 81% in 2014; while the proportion from government subsidies and other channels (such as investment return) went up by 1 percentage point each to 14% and 5% during the period. The changes are not big but may indicate that due to shrinking of labor size and growing of aged population, the collection of pension fund will encounter challenges and government may need to increase subsidies to keep the balance working.

The future crisis for retirement is not only about the pension, but also about medical risks and the living quality.

China’s savings rate is expected to drop in the long term. The current working population is facing two major financial burdens, the caring and education of the kids and the caring of their parents (the seniors). The one-child-only policy has led to the family structure of 4-2-1, meaning heavy financial pressure for the working population in the middle. Moreover, the mortgage (in many cases a large portion of family income due to high real estate prices), along with the pursuit of quality of life and consumption, will lead to the trend that Chinese people will have decreasing saving rates.

Moreover, China’s basic medical insurance is far from providing enough protection. There will be big medical benefits gap after retirement and the out-of-pocket payment for chronic diseases and catastrophic diseases are large. For example, China does not offer long-term care insurance and the basic medical insurance does not cover most of the nursing and long-term care expenses. Patients pay most of the long-term care bills on their own and it will be a large sum of costs after retirement.

Chinese government has started to work with commercial insurers to offer supplemental catastrophic disease insurance for urban and rural residents (retired, unemployed, rural residents), but not for urban employees at this moment because the employees’ basic medical benefits are better than the residents for now. However, in a long run, we think that for employee benefits, there will still be big financial crisis ahead because China will see less working people putting money into the basic medical fund while more people getting older who needs to spend money on medical bills.

Thirdly, the parents of the current working population already or will soon enter the ages with high medical risks. The pension and medical benefits for the parents are not perfect as well. Therefore, before their own retirement, the current workforce will have to pay high out-of-pocket expenses for their parents on medical services, long-term care and living, which will further deplete their savings, increasing the risk for their own retirement in the future.

In conclusion, the retirement burden for current workforce is the combined risk of two generations.

With a benefit system that shows big gap in protection, China urgently needs supplemental products in long-term care, pension, and health. The current level of protection is not sufficient to prevent the risk after retirement. The aging of the parents will accelerate the burst of crisis of basic pension system and therefore, the introduction of supplemental benefits for the workforce will be essential and urgent.